Many fintechs start with a mission that addresses a problem. Whether that be financial exclusion or just plain fixing of the financial system’s inequities, fintech was born from innovation and challenging the status quo.

The fintech dream has got the sector far. Despite the recent drop in VC funding, global fintech funding has grown at a rate of 12% over the past five years. The impact of the sector’s success and maturation is mirrored in its adoption by traditional companies and changes in the regulatory landscape.

However, the sector’s tangible impact on the wider economy is rarely measured. There is a sense that individual companies are making a difference, but the fintech sector often has little research to back up its claim that it is working “for good.”

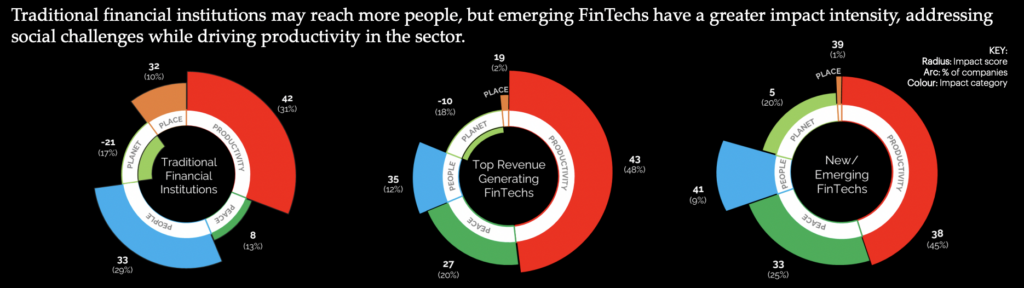

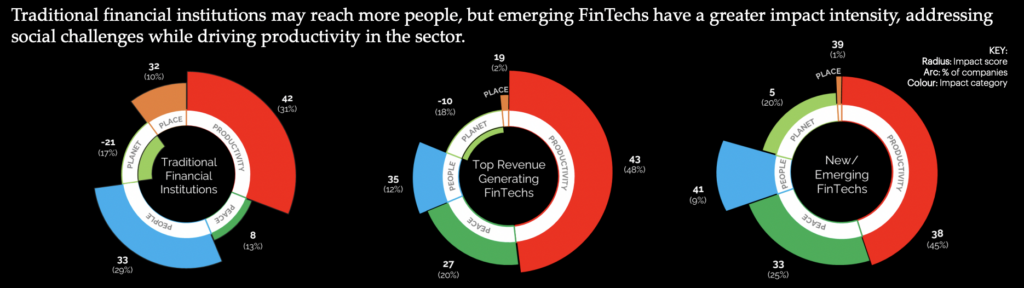

A study led by Innovate Finance and Accenture set out to measure the UK fintech industry’s impact on the UK economy. Using the UN’s Sustainable Development Goals, the study measured fintechs’ impact in areas of productivity, peace, reaching climate objectives, and inclusion.

“The best, and perhaps the only, chance we have as a society to solve some of the world’s greatest challenges will lay in mobilizing the private sector as a force for good,” said Kimberley Abbott, CEO of Vested Impact, which carried out the analysis. “But to effectively do this, we need to move beyond just looking at how companies behave and look instead at the positive, negative, and indirect impacts a company’s activities, products, and services have on the societies and environment around us; backed by data and science.”

While it found that fintechs had, indeed, made a difference in some areas, others still had a lot left to be desired.

A Positive Impact

Overall, the UK fintech sector scored a net impact rating of 49, slightly higher than that scored by Capital Markets, but under Telecom Services and Education Services. The majority (60%) of fintechs surveyed have a medium impact, with 37% measuring as high-impact contributors.

The main area of impact was productivity. The majority of the fintech sector was seen to contribute positively to the productivity of the UK economy, creating jobs and improving SME access to finance. In addition, they were found to contribute greatly to the establishment of new infrastructure, particularly as users of open banking, despite wider challenges for adoption.

“UK FinTech currently employs over 200,000 people through more than 3,400 unique companies, each driven by their mission to create innovative solutions to make financial services more effective and better for all,” said Janine Hirt, CEO of Innovate Finance.

According to the research, a significant contributor to the sector’s productivity impact is its focus on innovation. Fintechs were found to enable the efficient running of other businesses, providing alternative access to financial products.

Fintechs were also seen to contribute to creating a stable economy. Forty-one percent of fintechs were found to have a “significant impact on the safety, accountability, and legitimacy of financial flows,” and 26% improved the transparency of institutions.

Room For Improvement

While the productivity of fintechs’ impact was highly represented, when it came to wider societal challenges, a lot was left to be desired. According to the report, 19% of fintechs have some form of negative impact on people. This manifests in a number of forms, ranging from exposing consumers to new, unregulated risks to perpetuating a lack of diversity through unfocused hiring.

“There’s no doubt that the UK FinTech sector has stepped up to help society navigate unprecedented levels of change in recent years, whether it’s facilitating easier payments, improving the transparency of sustainable investing, or boosting financial inclusion,” said Graham Cressey, Accenture’s London FinTech Innovation Lab Director. “However, barriers to fairer representation in the industry still exist, which are preventing it from reaching its full potential.”

Significant areas of inequality remain unaddressed, starting within the employment of the sector itself. The gender gap in the UK fintech sector is wider than in traditional finance, with only 28% of its workforce identifying as female. In the higher ranks of businesses, representation reduces significantly, with women holding only 10% of fintech board seats.

“The sector remains a male-dominated industry with data clearly showing that it lags behind national averages on numbers of women as directors, the number of women-led fintechs, and particularly discouragingly, that women-led fintech businesses are significantly less likely to secure private investment than in other sectors. Whilst the fintech sector is clearly an economic success story, it is not an inclusive growth story,” said Alex Craven, Co-Founder of Data City

The report stated that this lack of diversity could impact the continued development of the sector. In a sector driven by innovation, an increased diversity of ideas was said to have the potential to add value.

Despite many fintechs focusing on improving financial inclusion, the study found that the rate of impact was dwarfed by increased economic challenges that could exacerbate the growth of the underserved market. Credit practices were still seen to exacerbate inequality, and a slow rate of engagement in sectors, such as remittances, was found to be inadequate.

Environmental goals were found to be the worst addressed by fintechs in the sector. The growth in impact investing and consumer awareness of climate issues has done little to improve the impact of the UK fintech sector. While companies showed a willingness to reduce their emissions, few were engaging in the implications of their practices.

While some fintechs have made a significant impact in areas such as ESG transparency, a dependency on fossil fuels and high levels of water to power the industry undermines their impact. In addition, the report found that the emissions associated with institutions, investing, lending, and underwriting activities are, on average, over 700 times higher than the direct emissions that come from their daily operations.

RELATED: Fintech’s Scope Three Opportunity

The Context- The UK Government’s Focus On The Impact Vectors

However, the impact doesn’t happen in a vacuum, and a view on government movements may explain fintech’s deficiency in impact in certain areas.

Despite increased awareness and engagement of UK consumers in reaching climate objectives, the UK government has made steps that contradict the public sentiment. In 2022, the high court ruled against government officials, stating that their climate impact strategy was “not fit for purpose” and lacked insufficient detail on how goals would be met. Prime Minister Rishi Sunak has since been criticized for his approach to green policies, announcing changes that would weaken the UK approach.

Steps in improving the diversity and inclusion of the economy have been more focused, leading to the commissioning of multiple reports assessing its current state. Individual government bodies have published diversity strategies for their own workforces, encouraging others to do the same. However, to drive inclusion in STEM subjects, which feed directly into fintech, many found their strategy to be left wanting.

The Fintech Impact report identified reasons for some of fintech’s lack of impact, which may derive from their comparative size. It found that 70% of fintechs were low in effect, indicating that a lack of scale may be a barrier to their delivering on impact. They found that partnerships and collaboration could be key to solving this deficiency.

“Through cross-industry collaboration and a solid understanding of technology, data and how to measure what matters, UK FinTech can continue to lead the way and bring even more positive change in partnership with the broader financial services industry,” concluded Hirt.

RELATED: Is the UK still a hotbed for fintech innovation?

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }