It has finally happened. More than a decade after receiving the first spot bitcoin ETF application the SEC gave its approval yesterday.

While this was widely expected, it wasn’t a slam dunk as demonstrated by the tight vote: 3-2 in favor with SEC Chair Gary Gensler providing the deciding vote.

In total, 11 spot Bitcoin ETF applications were approved, many from some of the biggest names in finance such as BlackRock, Fidelity and Invesco. All 11 ETFs have already started trading today.

This marks a major milestone for the mainstream acceptance of cryptocurrency. Love it or hate it, crypto is going to be around for a very long time and these ETFs provide the simplest way for everyday investors to hold bitcoin.

Interestingly, the price of bitcoin is up in the last 24 hours but Ethereum is up even more as crypto traders expect the next step is the acceptance of an Ethereum ETF.

But given the track record of the SEC that is likely not going to happen quickly.

Featured

SEC Approves Bitcoin ETFs for Everyday Investors

The exchange-traded funds will allow investors to buy bitcoin as easily as stocks or mutual funds.

From Fintech Nexus

> Every lender has a fraud problem, but AI-powered detection is here to help

By David Snitkof

Fraud is a significant challenge for lenders, impacting both operational efficiency and financial stability. Legacy methods for detecting fraud are proving to be inadequate in the face of new techniques, so AI-powered detection is needed.

> Long Take: Carta’s misstep and exit from secondary markets point to a bigger problem

By Lex Sokolin

A lesson in the complexities of private equity.

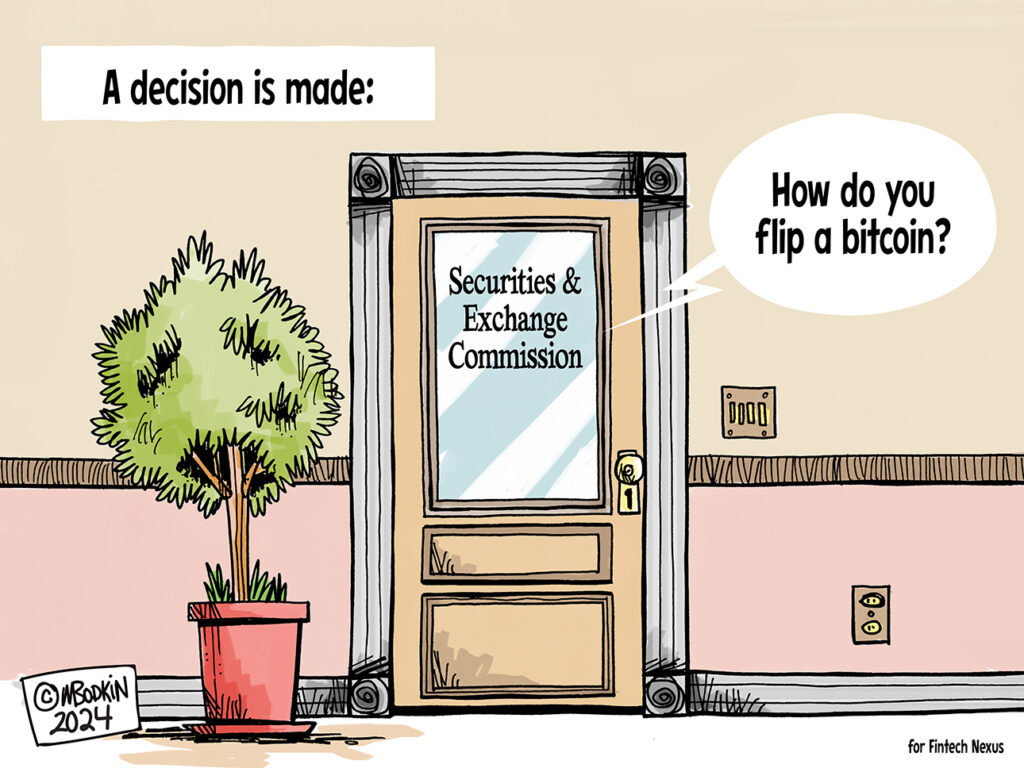

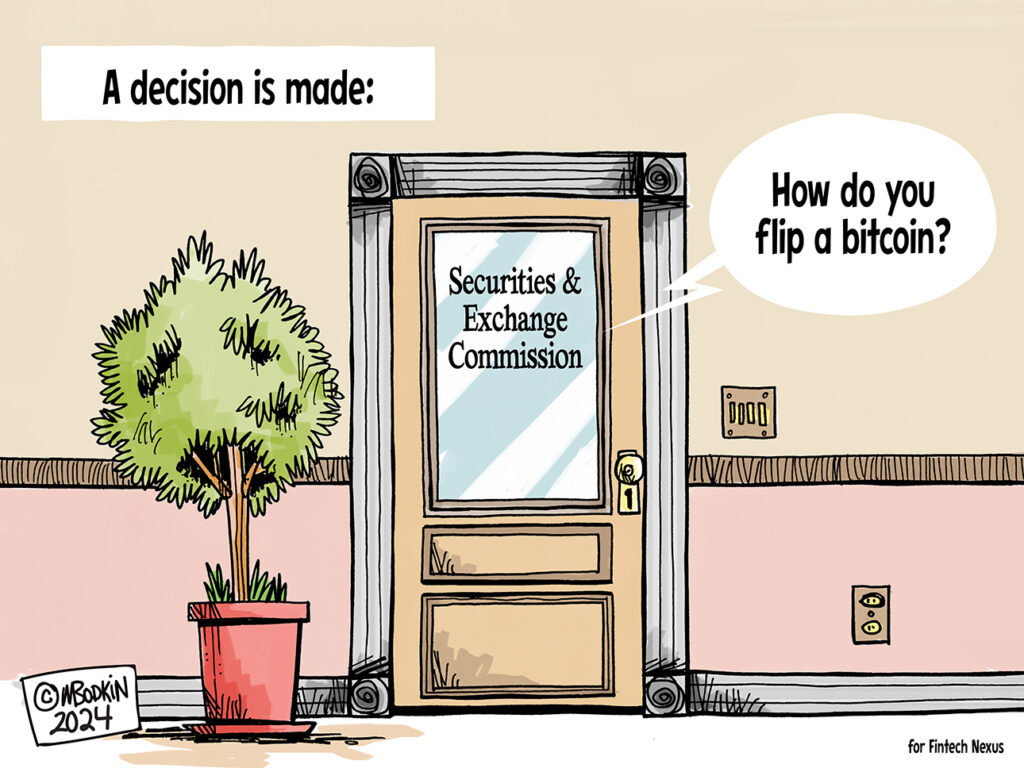

Editorial Cartoon

Webinar

High Performance Payouts: Why real-time Pay to Card is revolutionizing access to cash

Jan 17, 12pm EST

Real-time payouts have never mattered more than they do in today’s digital economy. Across platform economies – serving creator…

Also Making News

- USA: SEC ‘Squandered a Decade’ Rejecting Bitcoin ETFs: Commissioner Hester Peirce

Spot Bitcoin ETFs will start trading Thursday, but one crypto-friendly SEC Commissioner says it’s a day far too long in coming.

- USA: IRS move narrowing access to tax data sparks lender outrage

The agency plans to restrict access to a system that provides borrower tax returns to mortgage lenders beginning June 30. Left out of the loop, small-business lenders say getting credit to borrowers will become more difficult as a result.

- LatAm: Nu Mexico lets customers receive payments from US via WhatsApp

Nubank customers in Mexico can now receive money from the United States via WhatsApp thanks to a partnership between the digital banking giant and Felix Pago

- USA: The Fed Launched a Bank Rescue Program Last Year. Now, Banks Are Gaming It.

Borrowing at the bank term funding program is up to record highs, but not because of new stresses.

- USA: How payments companies are driving their businesses forward

From Mastercard partnering with banks and third parties in new open-banking relationships to PayPal stepping into the cryptocurrency payments market by launching its own stablecoin, payments firms are taking on new opportunities.

- USA: Pier banks $2.4M to launch ‘Stripe for credit’

Developers add Pier’s APIs with a few lines of codes, and the company then manages the credit lifecycle from end-to-end.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.