Enjoying our podcasts? Don’t miss out on future episodes! Please hit that subscribe button on Apple, Spotify, YouTube, or your favorite podcast platform to stay updated with our latest content. Thank you for your support! Nico Simko, Founder & CEO of Clair I have made no secret of my affection for earned wage access (EWA) as a product. It […]

Ready to Sign Up for a Gen AI Certification Program? Fintech Founders & Others Weigh In on the Trend

The use of Generative AI tools is on the rise, and with it has come the emergence of professional certification programs that specialize in Gen AI knowledge and training. Fintech firms—particularly those that tout their Gen AI expertise—are being asked to consider whether such programs are helpful to their employees and technology teams at this […]

Enjoying the podcast? Don’t miss out on future episodes! Please hit that subscribe button on Apple, Spotify, or your favorite podcast platform to stay updated with our latest content. Thank you for your support! It is a simple problem that every card issuer has. You have issued a credit or debit card to a new customer, so how […]

First came CoDi, or “Cobro Digital” (Digital Collection). But it didn’t take off. The system, launched by the Bank of Mexico to accelerate instant payments in the country, was pioneering even before Pix came online in Brazil a year later. But it did not succeed, and today, most Mexicans are unaware of what it entails. […]

This is a revolutionary time for the card industry. I felt that same way twenty years ago, when Visa was expanding into debit and began envisioning ourselves as not just a card company, but an electronic payments company. New technologies introduced opportunities for new products, serving customers that we had never reached before. Across the […]

Greenlight has been a leader in helping young children and teenagers develop financial skills. Its app is used today by more than six million parents and children. While the company was traditionally focused on a direct-to-consumer model, it is increasingly developing partnerships with large banks to accelerate its growth. Yesterday, we learned of another partnership, this time […]

A consortium of Argentine banks has formally accused Mercado Libre, often dubbed the Amazon of Latin America, of abusing its dominant market position in the fintech sector. This marks a significant escalation in a longstanding dispute between the financial sector and the Buenos Aires-based fintech giant, which remains unresolved and could affect Mercado Libre’s neobanking […]

Robinhood is still bullish on crypto despite the SEC warning the company it plans to sue over this part of its business. We learned yesterday that Robinhood will acquire crypto exchange Bitstamp for $200 million, making this its largest acquisition to date. The acquisition comes just a month after Robinhood received a Wells notice from the SEC over its […]

Enjoying our podcasts? Don’t miss out on future episodes! Please hit that subscribe button on Apple, Spotify, YouTube, or your favorite podcast platform to stay updated with our latest content. Thank you for your support! Jane Larimer, President & CEO, Nacha The largest payments network by volume is the ACH network. A dollar value of several times US GDP […]

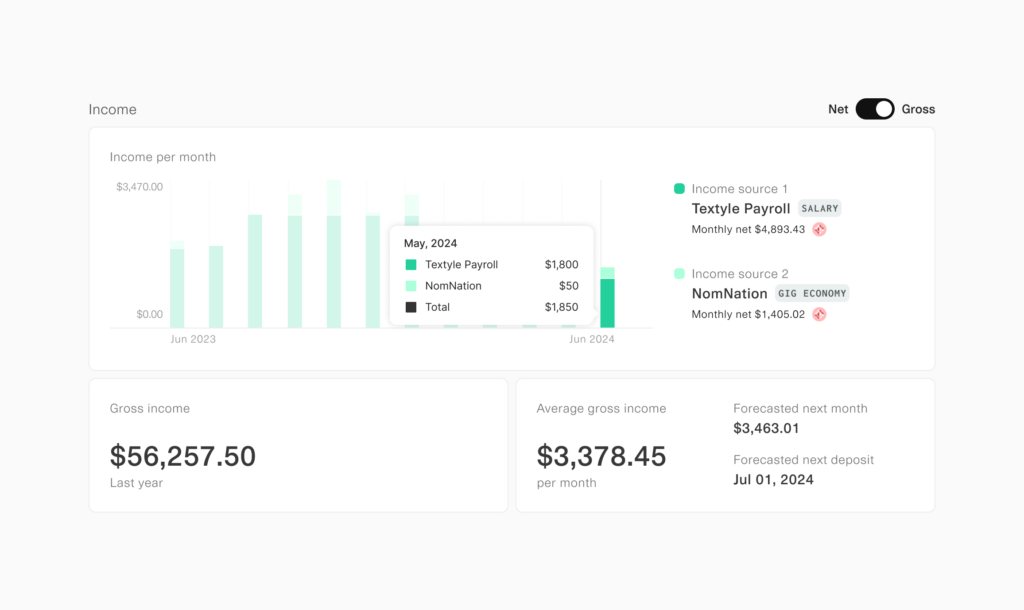

Cash flow underwriting has been “the next big thing” in lending for several years now. And while several lenders are using it as part of their underwriting, it has not become a mainstream tool. That could change with the announcement today from Plaid. While Plaid first announced a cash flow underwriting initiative a year ago, […]