At DevConnect, Ethereum’s cypherpunk core collides with the pull of mainstream opportunities On my last night in San Martín de los Andes, a bus-full of Edge City residents wound its way uphill to enjoy a delightful asado dinner — ribeye, lamb, flank steak, maillard-crusted veggies, a lettuce leaf or two. Pure decadence. Three hours and […]

New data from fintech Mercury shows AI-generated search driving shifts for ecommerce operations AI isn’t just reshaping how customers find products—it’s reshaping how ecommerce companies operate. According to new data from Mercury’s 2025 Ecommerce Holiday Report, nearly nine in ten respondents (86%) said they rely on AI extensively or somewhat in their business operations, and […]

As AI devours traditional web traffic, blockchain startups are reviving the dream of user-owned data and agent-powered micropayments. The question of how to power the internet has been a stubborn source of debate since more or less the genesis of the information superhighway. (We mean “power” metaphorically speaking.) How to address this question has been […]

“I regularly evaluate the companies out there that are AI native and trying to solve these problems: teams founded by the people who used to run AI and machine learning at Stripe and all these other companies, and it’s not that hard to break their stuff. If it was, I would be buying them.” Reust […]

DeFi has long sought sustainable yield beyond speculation. By combining DeFi’s transparency and liquidity with reinsurance’s stability, this emerging intersection could redefine productive yield generation. Throughout its existence, decentralized finance has been defined by reflexivity native to itself. Returns have been generated by volatile token issuances, leverage loops, and cyclic market sentiment rather than from […]

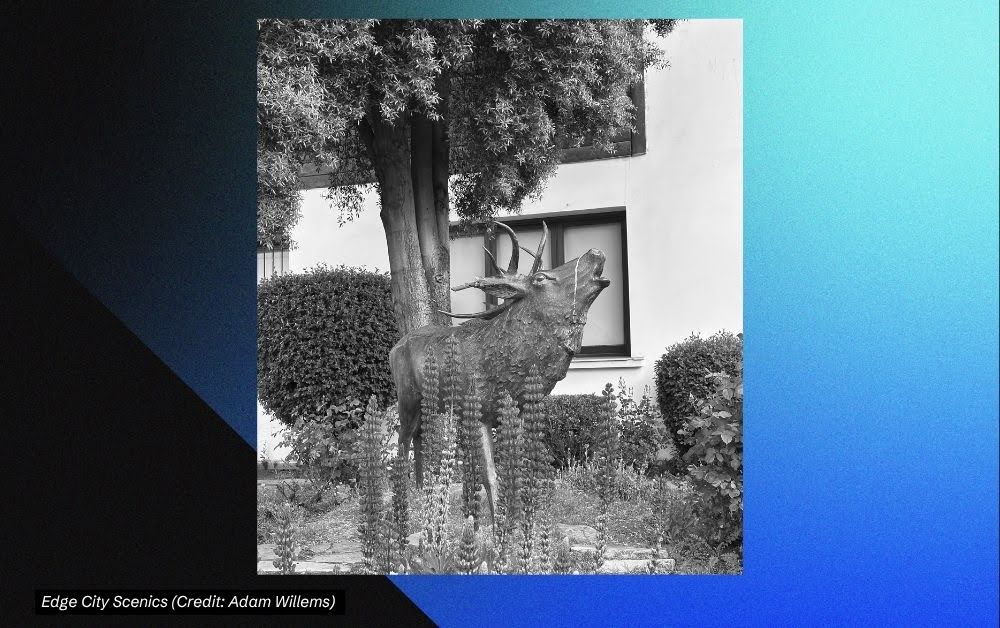

If you’ve never been to San Martín de los Andes in Argentinian Patagonia, and you’ve never been to the Southern Hemisphere at all, let me me offer you a smattering of reference points from the Northern Hemisphere to paint a picture: It’s a mix of Niseko’s outdoorsiness and economy (Japan), Landour’s temperamental weather (India), and […]

As Washington embraces crypto–and is developing new policies to build a framework for the industry–Future Nexus recently spoke with Ji Kim, CEO of the Crypto Council for Innovation about the opportunities and challenges facing the industry heading into 2026 Perhaps unsurprisingly, after years waiting in the wings, crypto-lobbying groups have come out in full force […]

“If someone walks away with a plan and has met the three people who are going to change their career or company, that’s going to drive people back again and again and again.” Stefan Weitz sees potential where others see uncertainty. As co-founder and CEO of HumanX, his mission has been to channel the chaotic […]

Hi there and welcome to Funded, where we spotlight early-stage bets on the future of tech. This week, we’re highlighting a bold $80 million seed raise for Reevo, a Santa Clara-based startup building an AI-native revenue operating system to replace the patchwork of go-to-market tools used by B2B teams. Reevo’s impressive seed raise, co-led by […]

As murky sentiment looms over the housing market, Michael White sees a bright spot for tech to tamp down mortgage troubles As the Federal Reserve weighs its next rate move — and Treasury Secretary Scott Bessent warns of a stagnating housing market — mortgages are once again in the national spotlight. Against this backdrop, Multiply […]