The third largest fintech ecosystem in Latin America, Colombia has been a coveted market for many startups undertaking regional expansion. The second most populous country in South America, with over 50 million citizens, leading digital banks such as Nubank and Uala set foot in Bogotá in the past two years. Both have successfully rolled out […]

The collapse of Silicon Valley Bank (SVB) will improve financial system health if it moves society towards decentralized systems, one fintech CEO says. A move to DeFi pulls the system away from single points of failure that caused the most damage over the past few weeks, Paystand CEO Jeremy Almond said. As he watched SVB […]

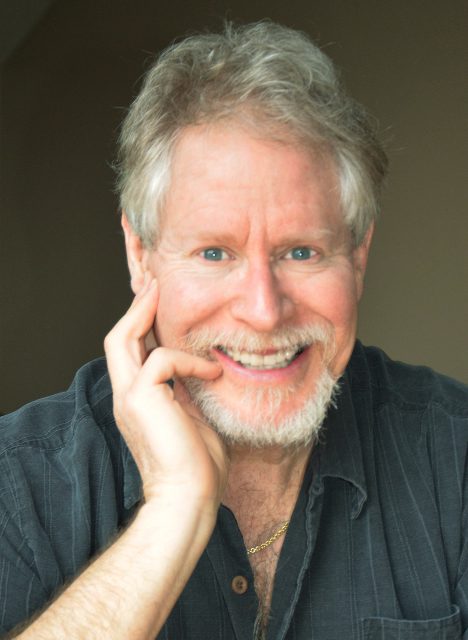

On today’s episode, I am joined by Ron Ross, Co-Founder, President & COO of Everee. Ron and I talk about his journey to starting a company, his CFO experience in raising capital, the problems with and incentives around payroll, the path to payday becoming every day, the Boston Red Sox, and much more. A couple of short […]

Dan Michaeli of Glia When we have a customer service issue with a bank, credit union, or fintech today, we often approach it with some trepidation. So many organizations provide a poor experience that is painful and frustrating for their customers. But we have the technology now for customer service to be exceptional. My next […]

Walmart Mexico, a division of the U.S. retailer, announced the acquisition of Mexican payments startup Trafalgar Solutions, which is expected to strengthen its digital wallet initiative. The retailer giant had said in early March that it had gained regulatory approval to buy a fintech institution. This week, it confirmed the company is Trafalgar but did […]

As it pivots to monetization, Nubank rolled out one of its core products for 2023. The digital bank began offering payroll lending recently to scale up its loan business and prop up how much revenue it extracts from its vast customer base. The Warren Buffet-backed company began testing payroll-deductible loans this quarter with its client […]

The Biden Administration’s recent decision to end the Small Business Administration’s (SBA) decades-log moratorium on licensing new lenders opens the doors for community banks and credit unions to meet the needs of underserved communities, industry representatives believe. Credit regulators for seeing through the obfuscation efforts of some incumbents. The SBA has lifted the moratorium on […]

A few months after consolidating its business in Chile, UPago, the Chilean recurring payments fintech, recently expanded its operations to two key countries in this financial segment: Mexico and Colombia. According to the company, this expansion aims to consolidate the fintech as one of the major players in LatAm, helping small businesses reduce payment costs […]

The following is a guest post from Mark Lusky, president of Lusky Enterprises, Inc. Such Corporate Social Responsibility (CSR) initiatives and certifications as ESG and B Corp are getting buffeted by corporate and political polarization around “doing good” versus “doing well.” The former addresses a commitment to help corporate stakeholders—including customers, clients, employees, partners, communities, planet, […]

Meta announced on Wednesday that it would begin operating payments from individuals to businesses through WhatsApp in Brazil, following the authorization the company received in March of this year from the Brazilian Central Bank. This new service, which covers credit, debit, and prepaid cards, will start with the participation of 15 banks, three acquiring companies, […]