Crypto’s history of centralized custody is not a positive one. For most of the crypto-curious, high-profile failures of crypto custodians spring to mind. MtGox, FTX, and Prime Trust are just some that have left investors with little hope of recovering their assets in full. Now, for many, self-custody is the only way forward.

But when it comes to institutions, the idea of crypto self-custody becomes more complicated. For asset managers in particular, SEC laws, which Chairman Gary Gensler noted, “cover a significant amount of crypto assets,” prohibit self-custody of client assets.

“Securities laws prohibit investment fiduciaries that are subject to the SEC Custody Rule from both managing and custodying customer assets,” said Caitlin Long, CEO and founder of Custodia Bank.

“Although Bitcoin isn’t a security, and although some asset managers (such as pensions, endowments, and foundations) aren’t subject to the SEC Custody Rule, most investment fiduciaries use a third-party custodian for all asset types as a best practice, even if not legally required.”

On November 7, 2023, Custodia Bank launched a Bitcoin custody platform for institutional customers.

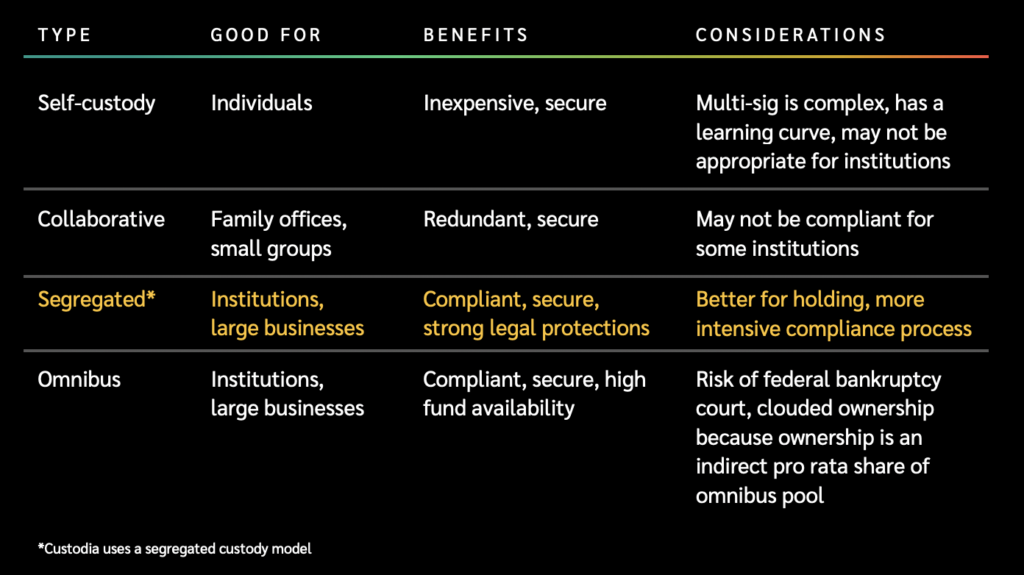

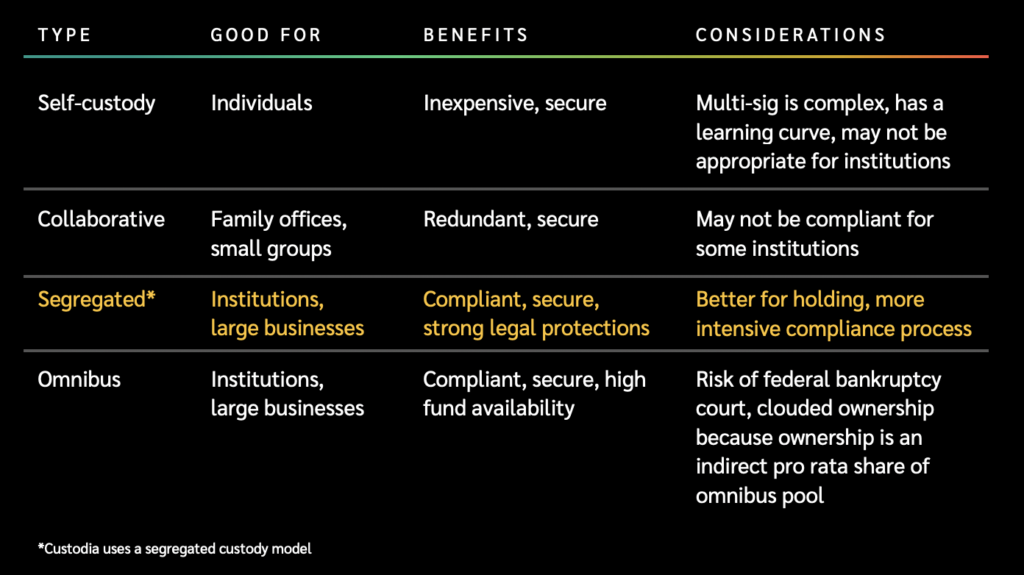

Using its position as a Wyoming Special Purpose Depository Institution, the bank combined its compliance to digital asset-focused regulations with a segregated account model. It says this approach provides a strong framework against risks institutions may face when engaging in digital assets.

“Custodia aimed to be ready to scale into the April 2024 post-Bitcoin halving environment, in which we anticipate a spike in demand for the custody service, and we hit that goal,” continued Long.

Creating Trust in a Jaded Market

Custodia enters the realm of Bitcoin custody at a critical time for trust in crypto.

Tainted by the high-profile failures of centralized crypto platforms in 2022, digital assets have lost some of their hype and, with it, their market cap. Ongoing regulatory uncertainty has also caused some institutions to remain cautious. Custodia Bank itself has felt the weight of regulators’ distrust of the crypto space. The bank’s focus on crypto caused its master account application to be declined earlier this year.

RELATED: Custodia Bank rejection: What’s next?

However, the institutional adoption of bitcoin remains promising. A number of large institutions are poised with pending Bitcoin ETF applications, and many have launched products providing access to the crypto space.

Custodia explained that rather than use the omnibus approach, central to their solution was a focus on segregated accounts. With this approach, the custodian stores customers’ digital assets on-chain in separate individual accounts, protecting the associated private keys. “Assets are not moved and cannot be pledged or rehypothecated to another party for any reason,” the whitepaper reads.

In the omnibus custody model, often adopted for securities, assets are moved to another location after being deposited. The final address is usually for offline storage or “intended for immediate access for other purposes.”

It is here that Custodia identifies potential risks for the safety of the assets. “The technical and legal allowance by the custodian to move digital assets from the original deposited location introduces serious risks that customers must consider, even if that movement is intended to improve the safety and transparency of those funds,” the whitepaper reads.

The segregated accounts solution is said to retain institutions’ visibility on assets while allowing them to delegate custody to a third party. According to the whitepaper, Wyoming’s SPDI laws also carry additional protections in case of Custodia’s failure.

RELATED: Custodia Bank goes live

“No other custodian is a bank that can settle US dollars simultaneously with bitcoin, offers the special customer protections that a bank offers in the event of a failure of the institution, and provides the extra customer protections offered by a segregated account structure that truly segregates customers’ bitcoin,” said Long.

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }