Last month, it was Chase, this month, it is PayPal launching a new ad business.

PayPal has hired Uber’s former head of advertising to run PayPal Ads, the new division that will be selling targeted ads based on its customer data.

Let’s consider PayPal’s scale for a second. In the first quarter alone, PayPal processed 6.5 billion payments from 400 million users. Each one of those payments is a unique data point that can be used for ad targeting.

PayPal users would be opted in by default but will have the ability to opt-out.

It will be interesting to see how these ads are received from PayPal’s customers once they are rolled out.

But I think we are seeing an entirely new product category emerge for those fintech companies and banks with enough scale.

Featured

> PayPal Is Planning an Ad Business Using Data on Its Millions of Shoppers

The payments company hires Uber’s former head of advertising to run a new ad division.

From Fintech Nexus

>Kueski, fintechs ride the BNPL wave in Mexico, where cash is still king

By David Feliba

Exclusive interview with Andrew Seiz, head of finance at Kueski, on the 2024 outlook for consumer lending and Buy Now Pay Later in Mexico.

Podcast

Joel Sequeira, Director of Product at IDology, on using AI in identity verification

There is no area of fintech moving faster than identity verification today. With new attack vectors coming online every day…

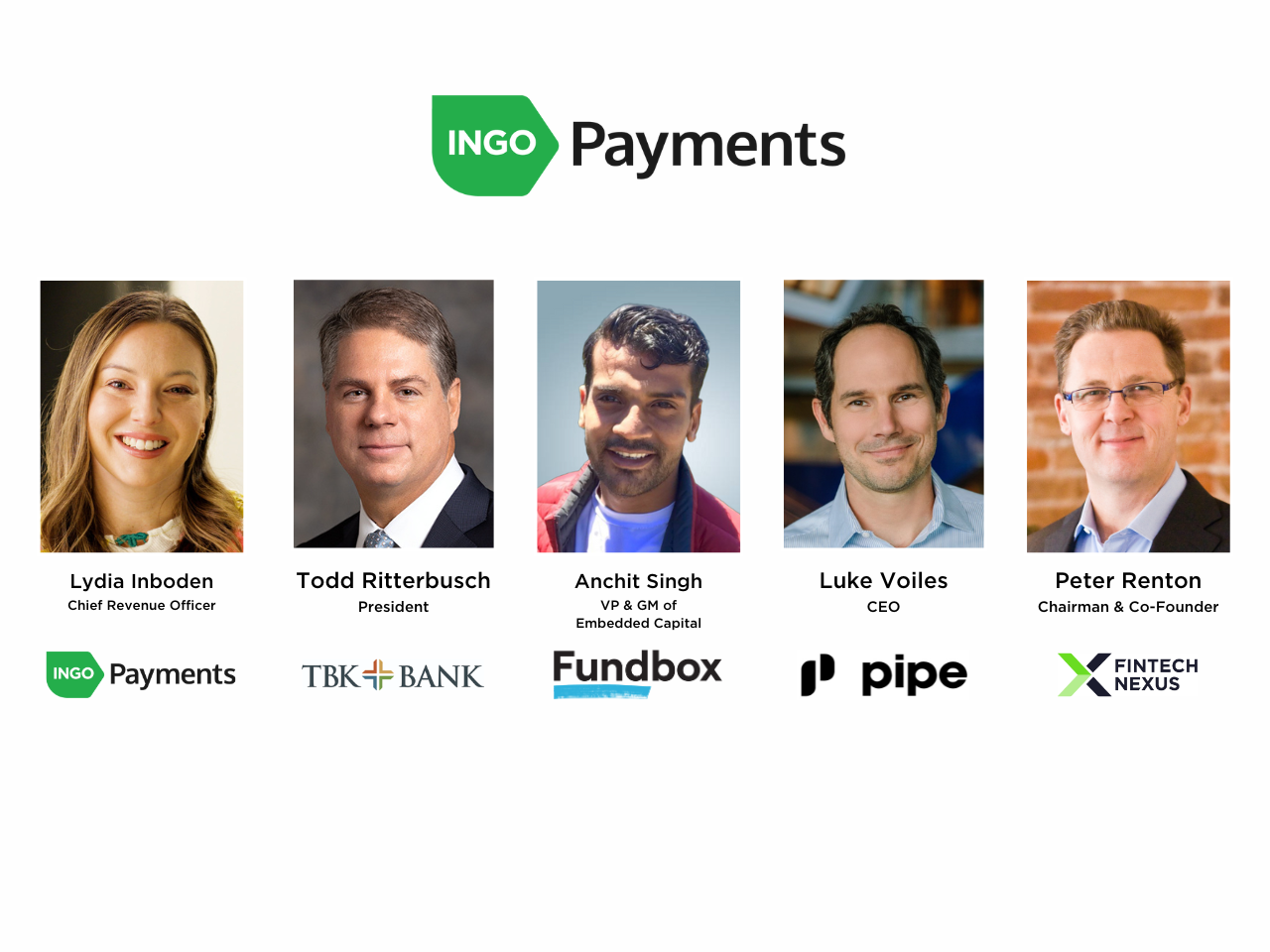

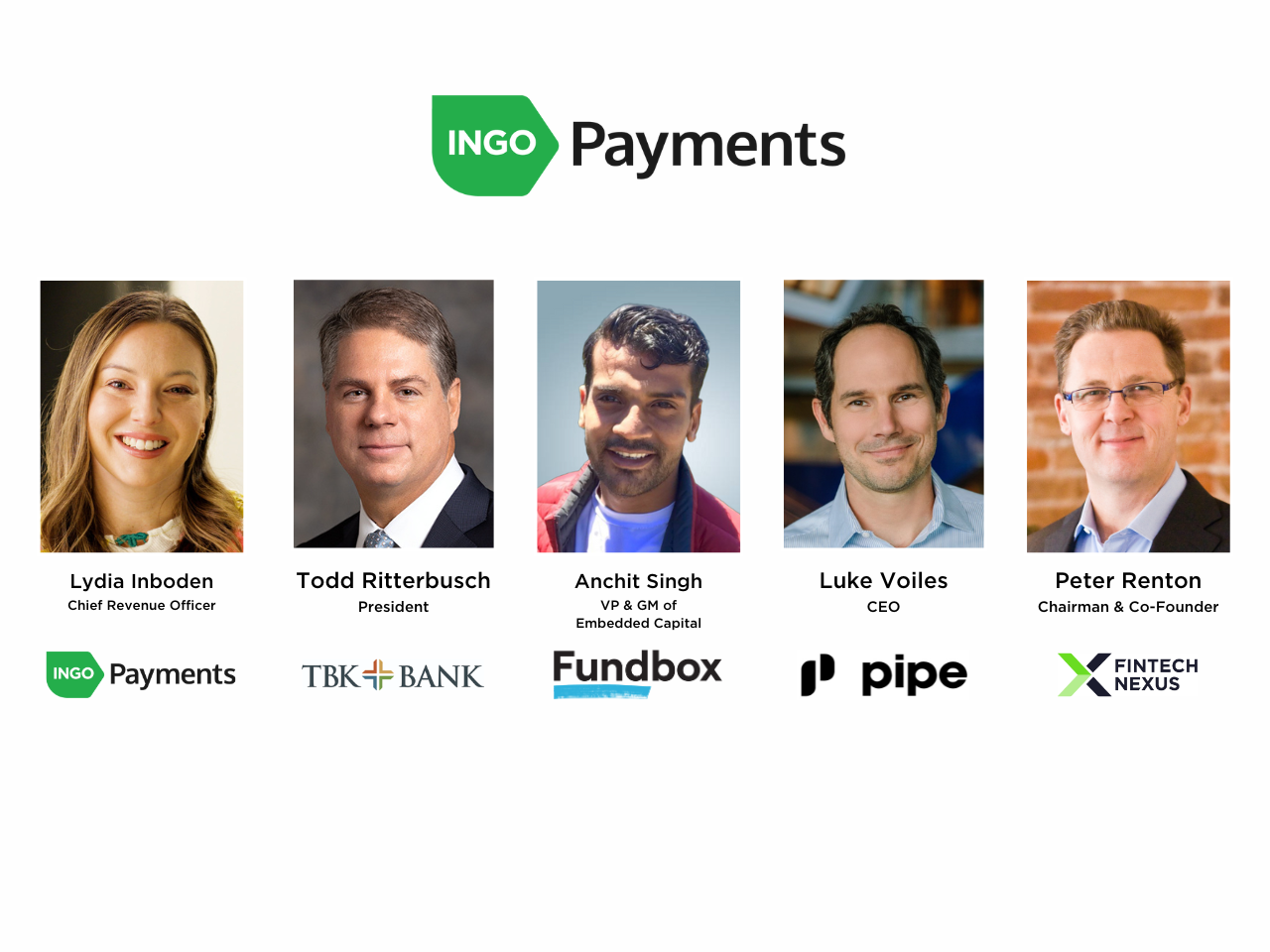

Webinar

Instant payments orchestration: an essential tool now for lending and factoring

Jun 5, 2pm EDT

In today’s on-demand economy, instant payments are moving from a nice-to-have to a must-have. In the small business space,…

Also Making News

- Global: How Visa and Mastercard are bolstering non-card payments

Rather than compete against the rising tide of account-to-account transactions, the two card networks are looking for ways to make themselves essential to this growing market.

- LatAm: More neobanks are becoming mobile networks — and Nubank wants a piece of the action

Nubank is taking its first tentative steps into the mobile network realm, as the NYSE-traded Brazilian neobank rolls out an eSIM (embedded SIM) service for travelers. The service will give customers access to 10GB of free roaming internet in more than 40 countries without having to switch out their own existing physical SIM card.

- Global: The New Operating System for B2B: Payments, Software and Data

There’s no shortage of complexities when it comes to the business relationship between buyers and sellers. There are payment methods, terms, timelines and compliance issues, to name just a few. Add economic uncertainty and high interest rates that make money scarce, and you place additional pressure on a business to run efficiently.

- LatAm: Félix Pago raises $15.5 million to help Latino workers send money home via WhatsApp

Remittances from workers in the U.S. to their families and friends in Latin America amounted to $155 billion in 2023. With such a huge opportunity, banks, money transfer companies, retailers, and fintechs are all trying make transfers more convenient on both sides of the transaction.

- USA: Is fintech the key to better debt collections?

Digital-first collection agencies such as TrueAccord, January and InDebted are analyzing consumer engagement signals and more to determine the most effective way for its clients to collect on debt.

- Europe: BaFin lifts N26 customer onboarding cap

After more than two years, Germany’s financial regulator BaFin has lifted a cap on the number of new customers that digital bank N26 can onboard.

To sponsor our newsletters and reach 180,000 fintech enthusiasts with your message, contact us here.