Like many others, UK Payment Service Providers (PSPs) have felt the squeeze of the challenging economy. In the past six months, its effects have rippled across the sector, leading to heightened fraud, business costs, and a wave of lost customers. Development in Open Banking could be key.

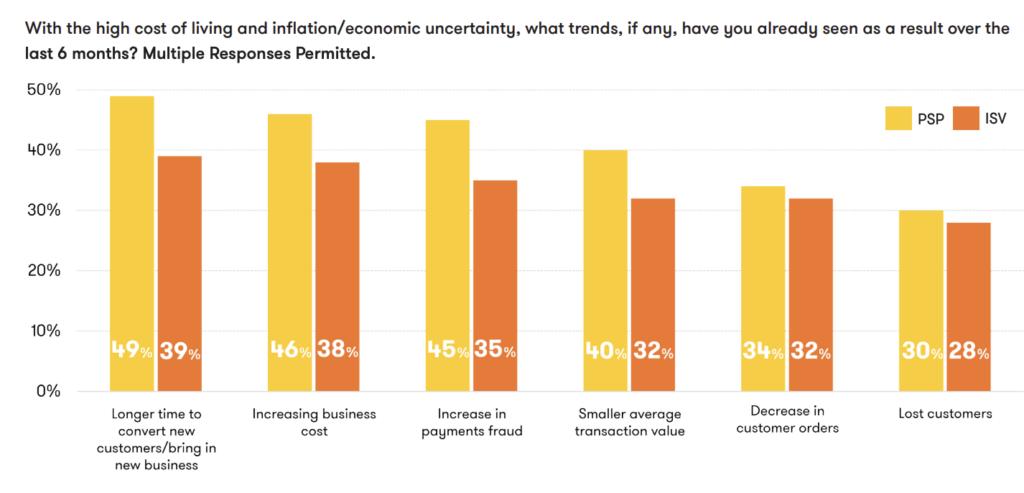

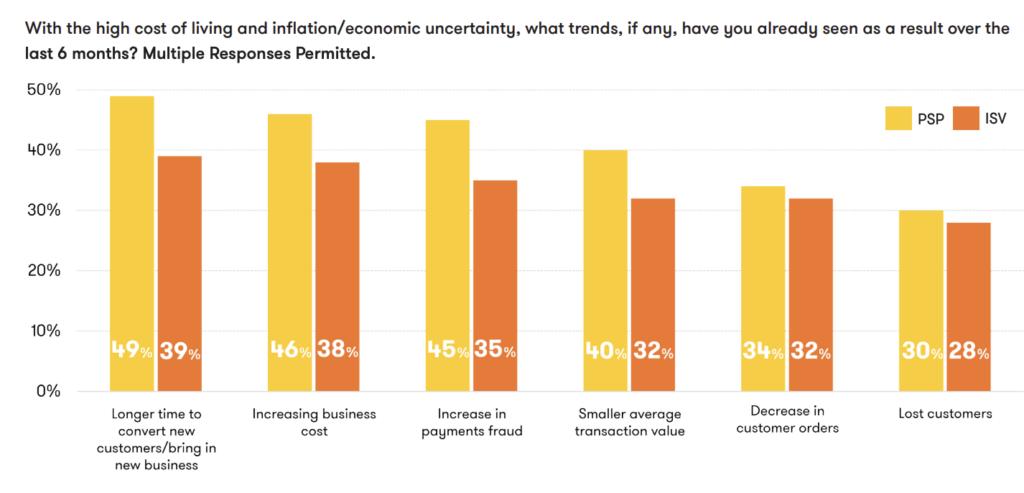

According to a study conducted by EML and Nuapay, every single one of the 250 payment professionals surveyed noted an impact of the cost of living crisis on their business. Almost half of all PSPs surveyed reported longer customer conversion times and declining transaction values. Their effects were compounded by heightened business costs caused by ongoing supply chain disruption, labor shortages, and elevated energy costs.

“The business challenges faced by PSPs and ISVs could potentially threaten payments innovation if headcount is reduced or revenue drops further,” said Ruwani Hewa, Product and Propositions Director, Nuapay. Over the past few years, in particular, innovative payment technologies have been a bright spot amid uncertainty, supporting the development of digital economies and keeping money moving. PSPs and ISVs have played a crucial role here, and it’s important that we continue to support them.”

In addition to the cost-of-living pressures, 45% of PSPs noted an increase in payments fraud. The Strong Customer Authentication (SCA) regulations, launched in 2019, were meant to target fraud levels and make online payments more secure. Instead, it has added increased friction to checkouts, and 70% of PSPs have seen checkout abandonment increase by 41-100%, adding to the declined rates of customer transactions.

“It’s clear that SCA regulations haven’t been the silver bullet that regulators hoped they would be. Instead, they have created serious checkout friction for consumers paying by card and – crucially – lost sales for businesses,” said Brian Hanrahan, CEO of Nuapay.

“However, with Open Banking payments, the user experience is much improved, with authentication already embedded on mobile. For instance, with Open Banking, consumers can use biometrics to instantly verify and approve payments.”

Development Of Open Banking Increasingly Important

In the face of these increased challenges, many consider Open Banking to retain significant potential in improving the conditions for PSPs. Almost half of PSPs in the Nuapay study noted that integrated payment technologies like open banking are essential to remain competitive.

“There’s no quick remedy to the business challenges faced by the retail sector, but experience has indicated that perfecting the payments process is integral to increasing customer loyalty, reducing basket abandonment, and opening new revenue streams,” said Hanrahan. “Adoption of Open Banking can support the retail sector and its enablers, including PSPs and ISVs, through a very challenging period.”

“Open Banking is a more cost-effective alternative to traditional payment options, bypassing expensive and inefficient rails that come with hefty third-party fees,” Hewa added. “Not only does investing in Open Banking technology mean that merchants can lower fees, but it also improves cashflow, as funds are settled in real-time.”

The Open Banking sector in the UK is currently growing at a rate of 10% month-over-month as more are recognizing its benefits. However, with only 9.5% of consumers and SMEs using Open banking services in January 2023 and only 10% of consumers said to be regularly active users, the sector has a way to go yet for mass adoption.

RELATED: UK nabs top spot in open banking league table

The Effect of Increased VRPs

Many PSPs see innovations like Variable Recurring Payments (VRPs) and Request to Pay (RtP) driving the adoption of Open Banking forward.

VRPs use open banking to enable users to set up authorized payments of variable amounts to be taken out of their accounts with trusted PSPs. The innovation is said to help with friction and ease of payments, particularly for subscription purchases, replacing the need for direct debits.

RtP has similar benefits, but instead of a direct recurring payment being authorized, merchants send a request to the customer for payment, and the customer can choose to accept, decline, or pay in part.

While PSPs see the potential for its usage, many noted that a lack of education in merchants and customers as to the benefits of the payment method had blocked significant adoption. A standardized framework for VRPs was also yet to be established, despite the PSD2 framework being established for over five years, creating frustration amongst PSPs.

“VRPs have the potential to fuel the next stage of Open Banking adoption. However, the industry needs a standardized framework for this to happen,” said Hanrahan.

While the Joint Regulatory Oversight Committee (JROC) announced its focus on the development of a VRP framework earlier this year a pilot is not projected for another two years. In the meantime, PSPs have looked to the private sector for solutions.

RELATED: CFPB Proposes Rule to Accelerate Open Banking

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }